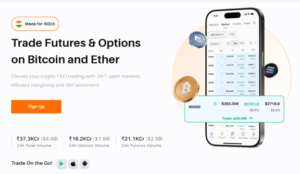

With the recent surge in India’s crypto user base, the demand for straightforward, reliable derivatives trading is at an all-time high. This is where platforms like Delta Exchange come in. By offering advanced tools and a regulated platform, it makes crypto trading more accessible for those just starting out.

In this post, we’ll look into what Delta Exchange offers for rookie traders, and whether it truly deserves a top spot on your list.

Understanding Delta Exchange

Delta Exchange was established in 2018 with one mission: to make crypto derivatives trading accessible for everyone. Fast forward to today, it stands out as one of the most trusted Indian crypto exchange platforms; plus it’s FIU-registered, indicating the focus on safety at every touchpoint.

Delta allows users to deposit, trade, and withdraw directly in INR – removing the headaches of currency conversions and opening the door for efficient local trading.

A Quick Recap: What are Crypto Derivatives?

Trading made quick and reliable on Delta Exchange

Crypto derivatives are contracts that let you profit from a crypto asset’s price changes without actually owning the asset. On Delta, you’ll run into three leading varieties:

- Futures contracts: A commitment to buy or sell an asset at a future date at a fixed price.

- Options contracts: The right, not the obligation, to buy or sell at a specified price before a given date.

- Trackers: Simple, non-leveraged contracts that mirror an asset’s actual price.

What Makes Delta Exchange Beginner-Friendly?

So, why does Delta Exchange get so much buzz among rookie traders? Here’s how it stands out:

1. INR-settled trading

Direct INR support is a huge benefit. You don’t need to shift between multiple stablecoins or dealing with hidden forex charges – Delta lets you fund your account and cash out proceeds directly in INR.

2. Start small, learn smart

No massive investments needed. With lot sizes from as low as ₹5,000 for Bitcoin and ₹2,500 for Ethereum, newcomers can start trading without going all-in from day one.

3. Automated trading bots

Not everyone wants to watch charts all day. Delta’s trading bots can automate popular strategies, running trades for you based on set signals – helping newbies manage trades without needing trading expertise.

4. Leverage options with caution

Delta allows leverage – up to 200x for experienced users. Beginners can choose lower leverage, ensuring that they aren’t accidentally risking more than they can afford.

5. Demo account

Not sure about jumping in headfirst? Delta Exchange offers a free demo account so you can test strategies, get comfortable with the interface, and learn the ropes before risking real funds.

6. Advanced tools, simple experience

Delta comes with tools like:

- Strategy builder: Experiment with multi-leg trades using basket orders.

- Payoff charts: Visualize potential gains and losses before placing trades.

7. Direct support and education

For every question, Delta’s support channels and knowledge base provide clear guidance, smoothening the journey for beginners taking their first steps.

8. Tax Simplicity

Crypto derivatives trading on Delta is not classified as Virtual Digital Asset (VDA) trading. This means the 30% VDA tax is not effective. Instead of that, any gains are taxed according to your regular income tax slab.

Getting Started

Delta Exchange excels in INR-trading

Curious to try it out? Starting on Delta Exchange is pretty straightforward:

- Sign up with your email or phone number – no complicated onboarding.

- Deposit INR through the available payment options.

- Select your crypto and choose a contract type – futures, options, or trackers, and plan your strategies.

- Use the dashboard or mobile app to place trades, adjust leverage, and monitor positions live.

- Once you close trades, profits are withdrawable straight to your bank account in INR – without unnecessary delays.

So, is Delta Exchange the Best Platform for Beginners?

Delta Exchange ticks many boxes for new crypto derivatives traders: simple INR management, the ability to start small, quick withdrawals, demo trading, and excellent support channels. The interface balances power with simplicity, and its legal standing gives confidence that the platform will be here for the long term.

Delta’s feature set – automated bots, strategy builder, and direct INR support – makes it a strong contender if you value convenience, security, and a learning-friendly environment. The ultra-high leverage options are there, but not forced on beginners, and the demo account is perfect for early experimentation.

Final Thoughts

If simplicity, safety, and direct INR settlements are top priorities, Delta Exchange is a worthy choice for anyone starting their crypto derivatives journey in India. With an easy start, flexible tools, algo trading bots, and strong regulatory compliance, it’s designed to help beginners trade confidently in a growing market.

To start crypto trading in derivatives, visit www.delta.exchange or join the community on X for the latest updates.

Disclaimer: Investing in cryptocurrency carries a high risk of market volatility. Kindly do your own research before investing.

I have been writing about Bitcoin, Ethereum and other digital currencies for over 5 years. My work has been published in major publications such as The Wall Street Journal, Business Insider and Forbes. It is also featured on CNBC, Bloomberg and other financial news outlets. I’m a sought-after speaker on the topic of digital currency investing and I have presented at numerous conferences around the world.